OPEN: MONDAYS TO FRIDAYS

TIME: 8:00 AM TO 5:00 PM (NO NOON BREAK)

1F Executive Building, Municipal Government Complex, Poblacion, Taytay, Palawan

0917-771-5580

[email protected]

Mandate

The Office of the Municipal Treasurer is mandated to collect taxes, fees and other revenues in accordance with the existing laws and ordinance of the LGU and to take custody and exercise proper management of local government funds. This office takes charge of the disbursement of all local government funds and such other funds of which custody maybe entrusted by law, and advises the chief executive and other officials concerned regarding the disposition of government funds and other matters relative to public finance. It also prepares and implements plans, programs and strategies for the efficient and effective collection of all taxes due to the municipal government and encourage elected officials for a strong political will by amending some provisions on LGU Tax Revenue Code to increase tax collection. Competency of its personnel is also continually updated and enhanced through trainings and seminars.

Services

The services provided by the Municipal Treasurer’s Office include the following:

- Issuance of Community Tax Certificate

- Computation and issuance of official receipt for business taxes, fees and charges

- Computation and issuance of official receipt for real property tax

- Computation and issuance of official receipt for regulatory fees and service user charges.

- Issuance of checks on the approved disbursements of the local government

- Information and Education Campaign on Real Property Tax

- Provide assistance to Provincial Treasurer in the issuance of the following:

- Notice of Delinquency

- Warrant of Levy

- Notice of Auction Sale

- Calibration of Pumps Sealing of Weights & Measures

- Branding of Large Cattle

- Conduct Field Collection

- Release to the beneficiary the grants and assistance from the national government and other agency.

- Provide assistance during national, local and special election

- Give incentives to taxpayers for prompt payment and plaques of appreciation for top 3 RPT payers

- Issuance of Tax Clearance upon the request of the taxpayer

- Issuance of certification related to treasury matter upon request

Citizen's Charter

- Collection of Municipal License and Permit Fees (Business and Municipal Tricycle Operator)

- Issuance of Community Tax Certificate

- Issuance of Land Tax Verification

- Issuance of Certification – No Property (Business, MTOP)

- Issuance of Certification (Tax Clearance)-with Property/Properties (Business, MTOP and Other Purposes)

- Collection of Real Property Tax

Department Head

IMLYN B. PARAPINA, CPA, BCLTE, MDMG, MPMDP

Municipal Treasurer

Municipal Government Department Head (MGDH)

IMLYN B. PARAPINA, CPA, BCLTE, MDMG, MPMDP

Municipal Treasurer

- Phone:0917-652-2234

- Email:[email protected]

Assistant Department Head

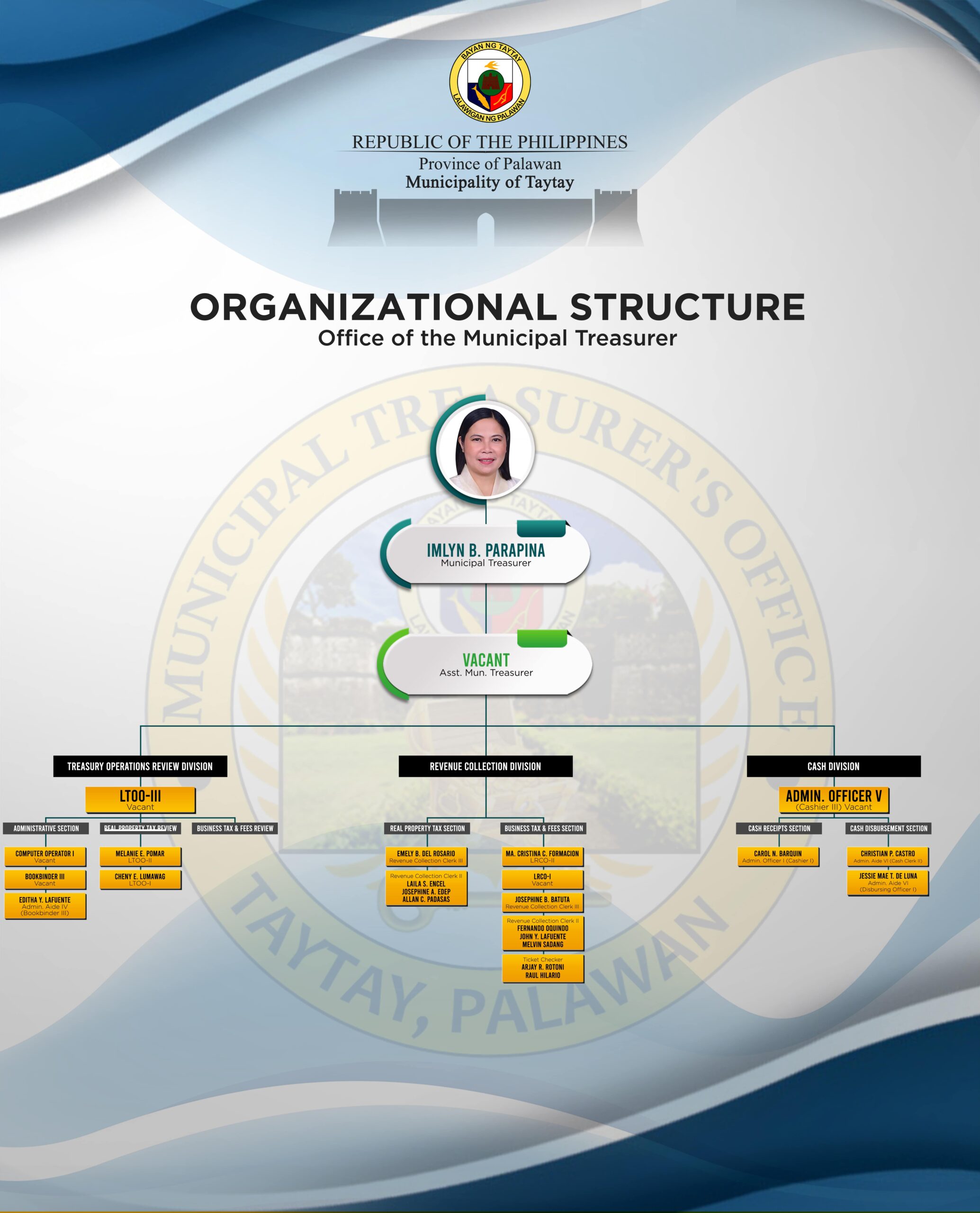

Organizational Structure